How Expense Management Apps Help Businesses Streamline Financial Operations

Businesses now have a more effective, precise, and user-friendly method of monitoring, controlling, and optimizing their spending thanks to the development of expense management apps.

Effective financial management is crucial for any firm, big or small, in the fast-paced commercial world of today. Historically, spreadsheets or manual labor were used for financial processes, particularly spending management. In addition to being laborious, this procedure was prone to mistakes, which resulted in inconsistencies and lost chances for cost reduction. Businesses now have a more effective, precise, and user-friendly method of monitoring, controlling, and optimizing their spending thanks to the development of expense management apps. This blog will discuss how these tools assist companies in streamlining their financial processes and why they are now a crucial component of contemporary business management.

What Are Expense Management Apps?

Software products called expense management apps are made to assist companies in monitoring, controlling, and maximizing their financial outlays. With the help of these apps, companies may automate the process of documenting, authorizing, and compensating employee expenses. These tools offer a comprehensive approach to managing business spending, from creating financial reports to filing receipts.

1. Improved Accuracy and Reduced Errors

The decrease in human error is one of the biggest advantages of adopting cost management software. In addition to being time-consuming, manually tracking expenses using spreadsheets or paper-based receipts is prone to problems like inaccurate data entry, misplaced receipts, and computation errors.

By allowing users to snap receipts with their phones' cameras and immediately submit them to the system, expense management app development services streamline these procedures. By using optical character recognition (OCR) technology, the software can automatically read and extract data from the receipts, lowering the possibility of human error. Additionally, there is no chance of losing crucial documents because the data is digitally preserved.

Businesses may guarantee the accuracy of their financial records and provide more trustworthy data for decision-making by lowering the possibility of errors.

2. Time Efficiency and Streamlined Processes

The process of managing expenses can take a lot of time, particularly when workers must file claims, wait for approval, and then receive reimbursement. Using spreadsheets or filling out paper forms requires a lot of tracking and back-and-forth communication.

Apps for managing expenses streamline the entire process. With only a few clicks, employees can classify their expenses, attach receipts, and report their expenses via the app. There is no longer a need for paper documentation because managers can accept or reject claims according to predetermined criteria.

Furthermore, reports may be created automatically with a single click, saving finance teams hours of labor-intensive data collection and analysis. Employees may concentrate on their primary duties rather than handling financial paperwork thanks to this automation, which also frees up time for other strategic activities.

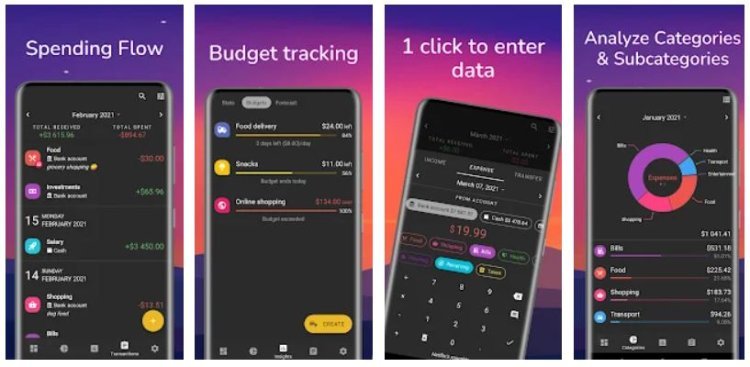

3. Real-Time Expense Tracking and Budgeting

Real-time tracking is one of the most potent aspects of cost management tools. These applications give companies a real-time picture of their financial status by enabling them to track expenses as they happen. For example, managers may monitor in real-time how much an employee has spent on meals or trips, which makes it simpler to stick to spending plans.

These apps can notify managers when spending is approaching or above certain limitations because they come with integrated budgeting capabilities. By taking a proactive stance, custom expense management app development companies can prevent financial surprises at the end of the month or quarter.

Additionally, having access to real-time data enables companies to make well-informed judgments on where to reallocate cash or make cost reductions in order to optimize operational efficiency.

4. Enhanced Compliance and Policy Enforcement

Companies frequently have strict guidelines about what kinds of costs are covered, how much can be spent on particular categories, and the paperwork needed for each claim. It can be quite difficult to manually manage adherence to these standards, particularly in large firms with hundreds of employees.

Integrated compliance capabilities in expense management apps facilitate the enforcement of corporate policies. Businesses may, for instance, establish guidelines for the highest amount that can be spent on specific expenses or mandate that receipts be provided for each claim.

The program automatically verifies that these guidelines are being followed when staff members report their expenses via the app. A claim may be marked for review if it goes beyond the permitted amount or if it is not supported by the required paperwork. This guarantees that policies are constantly followed and lessens the workload for finance staff.

5. Better Financial Reporting and Insights

Strong reporting features offered by expense management software help companies understand their spending trends. These applications enable companies to provide comprehensive statistics on a range of spending categories, including meals, office supplies, and travel.

Businesses can have a better knowledge of where money is being spent by classifying expenses and monitoring spending over time. Managers are able to spot patterns, find places where expenses can be cut, and assess how well their financial plans are working.

Furthermore, sharing these reports with stakeholders or integrating them with other financial tools, including payroll or accounting systems, is simple. Because the data is already arranged and current, this simplifies the process of getting ready for audits or financial reviews.

6. Improved Employee Satisfaction

Employees also gain from expense management apps since they make it easier to submit claims and get reimbursed. Employees may use the app to track the status of their claims and upload receipts immediately, eliminating the need for time-consuming paperwork and approvals.

Additionally, a lot of apps have speedy reimbursement options, which enable workers to get their reimbursements more quickly than with conventional ways. Because they don't have to wait weeks for payment, which can be frustrating, employees are happier as a result.

7. Cost Control and Fraud Prevention

Expense management software help businesses better control their expenditure by offering real-time data and automatic policy enforcement. By highlighting odd or redundant spending, these technologies can stop overcharging and fraudulent claims.

For instance, if an employee files two claims for the same travel or if an expense goes over business limits, the app can identify it. This guarantees that companies are not squandering money on pointless expenses in addition to preventing fraud.

With the help of bookkeeping app development company, businesses can also improve their overall expenditure visibility, which enables them to identify opportunities for cost reduction and make data-driven decisions.

8. Seamless Integration with Other Business Systems

The ability of expenditure management apps to interface with other corporate systems, like payroll platforms, accounting software, and enterprise resource planning (ERP) systems, is another important benefit. These interfaces lessen the need for manual data entry by facilitating more seamless data flow between various departments and systems.

For instance, if an expense is authorized, it can be automatically entered into the business's accounting system, saving the finance teams from having to do so by hand. Businesses benefit from this connection by being able to streamline their whole financial operations and keep accurate financial records.

Conclusion

Apps for managing expenses are transforming how companies manage their finances. These applications enable companies to optimize their financial workflows and make better decisions by automating procedures, decreasing errors, enhancing compliance, and offering real-time information. They save a great deal of time and money, expense management app development company helpful for businesses trying to grow and remain competitive in the fast-paced business world.

What's Your Reaction?